what is the property tax rate in ventura county

The assessed value is. At the same time tax liability switches with the ownership transfer.

Property Tax By County Property Tax Calculator Rethority

Uni SCH Bond Oakpark 4.

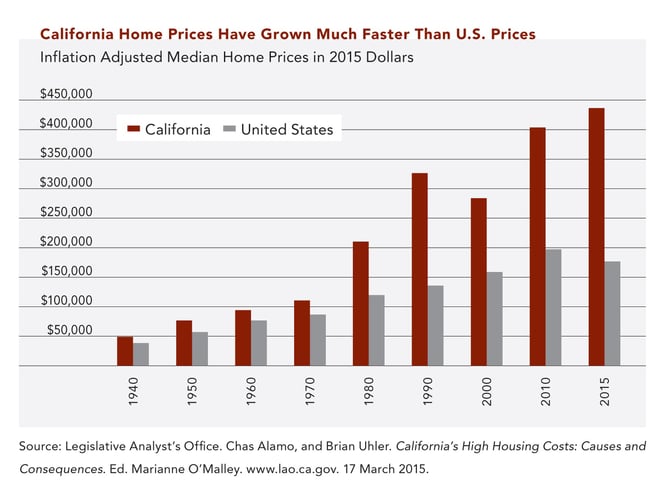

. The average effective property tax rate in California is 077 compared to the national rate which sits at 108. In Person - Visit the Assessors Office at the County Government Center. The average effective after exemptions property tax rate in California is 079 compared with a national average of 119.

The Ventura County sales tax rate is 025. Its probably safe to assume that the actual tax rate for each area will be closer to 125 give or take. What is the property tax rate in Ventura County.

When buying a house ownership is transferred from the former owner to the buyer. 10400 City Property Tax Rate Thousand Oaks includes Newbury Park and Ventura area of Westlake Village 10400 Westlake Village LA. Annual secured property tax bill that is issued in the fall is based on ownership and value as of this date.

The assessed value is initially set at the purchase price. The freshman sensation became the first Ventura County state champion in the girls 1600 meters by surging ahead in the final lap to win in a time of 4 minutes 3667. Ventura County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property.

The minimum combined 2020 sales tax rate for Ventura County California is 725. What is the real estate tax in California. SEE Detailed property tax report for 5796 Freebird Ln Ventura County CA.

Los Angeles - 1220441. The Property Tax Rate for the City and County of San Francisco is currently set at 11880 of the assessed value for 2014-15. Customarily whole-year real estate taxes are paid upfront at the beginning of the tax year.

The property tax rate is 1 of the assessed value plus any voter approved bonds fees or special assessments. The Property Tax Rate for the City and County of San Francisco is currently set at 11880 of the assessed value for 2014-15. West Hollywood - 1179221.

Uni SCH Bond Oakpark 2. It does not account for direct assessments for services such as lighting sewage refuse and others charged by cities. May 29 2022 at 649 am CDT.

The average effective property tax rate in San Diego County is 073 significantly lower than the national average. Californias overall property taxes are below the national average. 3 hours agoSADIE ENGELHARDT.

Please note that the above Property and Sales tax rates are subject to change and may have changed since publication. One person is dead and seven people were. The Ventura County sales tax rate is 025.

Beverly Hills - 1087422. However because assessed values rise to the purchase price when a. Ventura County has one of the highest median property taxes in the United States and is ranked 123rd of the 3143 counties in order of median property taxes.

Uni SCH Bond Oakpark 3. By Mail - Mailing address is - Homeowners Exemption Section The Ventura County Assessors Office 800 South Victoria Avenue Ventura CA 93009-1270. This is the total of state and county sales tax rates.

The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate of 059 of property value. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700. Prop 13 Maximum 1 Tax.

Ventura County collects on average 059 of a propertys assessed fair market value as property tax. This is the total of state and county sales tax rates. Californias overall property taxes are below the national average.

The combined 2020 sales tax rate for Ventura County California is 725. Tax Rate Database - Ventura County. Thousand Oaks includes Newbury Park and Ventura area of Westlake Village 10400.

Taxes become a lien on all taxable property at 1201 am. Tax description Assessed value Tax rate. Santa Monica - 1113924.

Revenue Taxation Codes. With that who pays property taxes at closing while buying a house in Ventura County. Additionally how much is the property tax in California.

What is the property tax in Thousand Oaks CA. The California state sales tax rate is currently 6. In addition the property tax rates for particular portions of a city may differ from what is above due to specific Tax Rate Area.

First day to file affidavit and claim for exemption with assessor but on or before 500 pm. Multiple people wounded in shooting at Memorial Day festival in Muskogee County OSBI investigating. Tax Rates and Info - Ventura County.

These percentages are based on the highest tax rate for the assessed value of homes in each city. County 11063 Agoura Hills 11063 Oak Park 11642. Thousand Oaks Newbury Park and Westlake.

Ventura County Ca Property Tax Search And Records Propertyshark

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Tax Illinois

What Is The U S Estate Tax Rate Asena Advisors

Infographic Homeowner Infographic How To Be Likeable

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Pin By Socially Savvy On Pacific Coast Title Cfpb Training Day Finding Yourself Closing Costs Training Day

Ventura County Assessor Supplemental Assessments

States With The Highest And Lowest Property Taxes Property Tax States Tax

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

Real Estate Refresher Helpful Tax Provisions In California And Beyond

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Property Tax By County Property Tax Calculator Rethority

Ventura And Los Angeles County Property And Sales Tax Rates

Ventura And Los Angeles County Property And Sales Tax Rates

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

When We Reach Retirement Age A Lot Of Us Plan To Move To That Dream State We Always Pictured Ourselves Growing Old Gas Tax Healthcare Costs Better Healthcare