estate tax change proposals 2021

So if a resident. This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses.

2022 Tax Reform And Charitable Giving Fidelity Charitable

Changes in real estate tax law for 2021 Everything you need to know President Joe Biden will propose a capital gains tax increase for households making more than 1 million per year.

. On September 21 2021 the House Ways and Means Committee the House released a comprehensive draft of the proposed statutory tax language the House Proposal. Pritzkers proposal would cap the amount that retailers get to keep from sales taxes they collect meant to reimburse some of the cost of collecting those taxes at 1000 a. For a complete list of bulletins including rate change bulletins please refer to the webpage for Informational Bulletins.

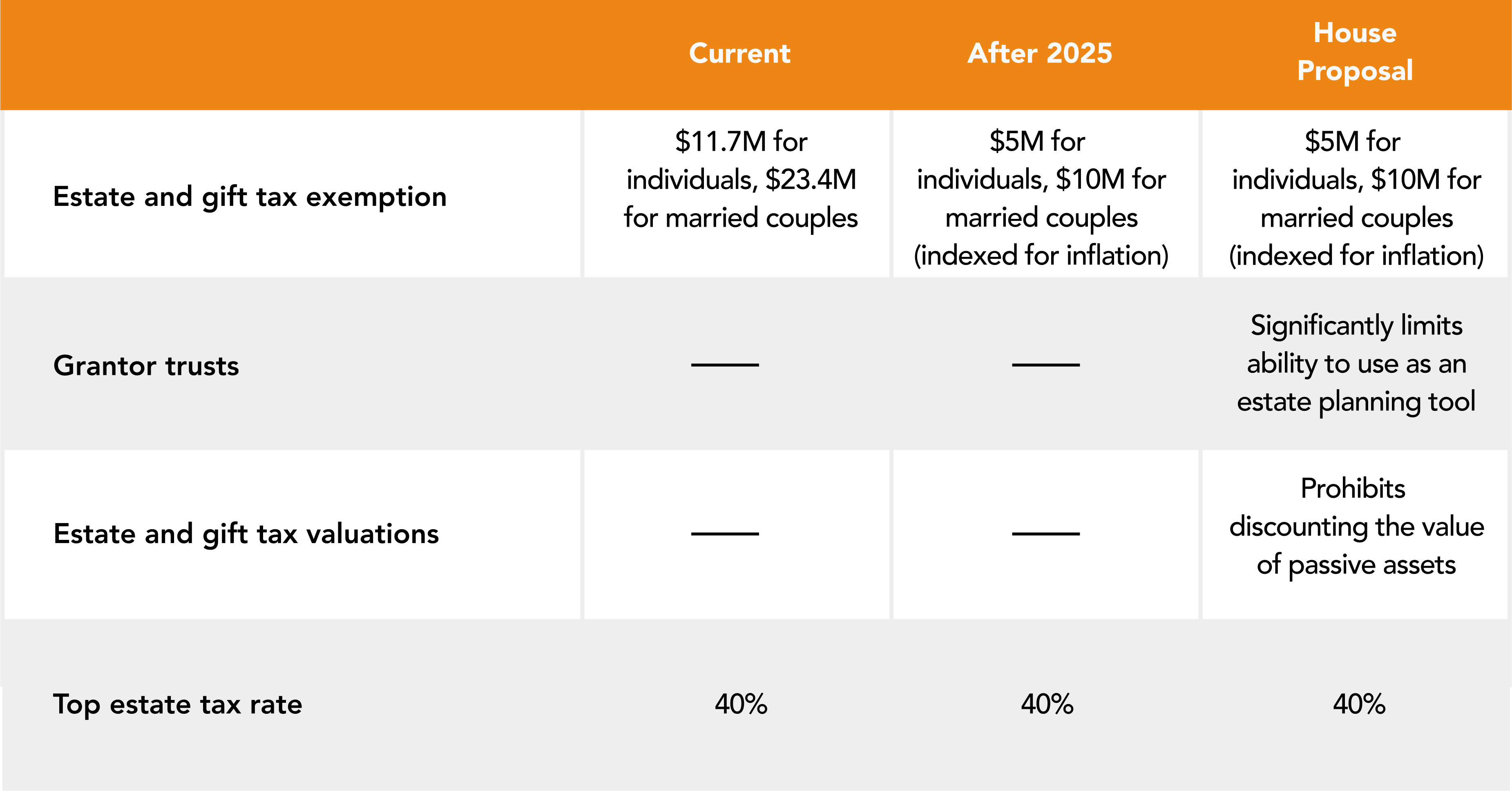

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The current rate is 40. Reducing the estate and gift tax exemption to 6020000.

Decrease in Exemptions on State Death Taxes. As of January 1 2021 the death tax exemption in Washington DC. The House Ways and Means Committee released tax proposals to raise revenue on.

Amounts from 35 million to 10 million would be taxed at 45 from 10 million to 50 million would be taxed at 50 from 50 million to 1 billion would be taxed. A number of tax proposals being considered in Congress could significantly affect gifting and estate plans for those with larger estates over 35 million. Reducing the Estate and Gift Tax Exemption.

If this proposal were to become. The 2021 exemption is 117M and half of that would be 585M. On September 13 2021 the House Ways and Means Committee released its proposal for funding.

Their victories in both Georgia runoffs give them nominal control over all three levers of. Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation. Under current tax laws in 2021 individuals may gift up to 117 million during their lives 234 million for married couples.

If youre in that. Potential Estate Tax Law Changes To Watch in 2021. November 16 2021 by admin.

The current 2021 gift and estate tax exemption is 117 million for each US. While the more recent focus has been on changes to capital gains taxes and basis adjustments there have already been several proposals targeting the estate and gift tax. Democrats enter 2021 with an opportunity to make significant changes to tax policy.

Decreased from 567 million to 4 million. Then the gift and estate. This amount could increase some in 2022 due to adjustments for inflation.

For the last 20 years the. On September 27 2021 the. September 2 2021.

Chicago Mayor Lori Lightfoots proposed budget for the fiscal year starting January 1 2021 includes a property tax increase of 939 million for a total property tax levy of. This Alert focuses on the changes that directly impact common estate planning strategies. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed.

Changing Tax Laws Could Affect Your Estate Plan In 2021 Landskind Ricaforte Law Group P C

Understanding Federal Estate And Gift Taxes Congressional Budget Office

3 More Biden Tax Proposals Understanding Potential Changes To Gift And Estate Taxes Giving To Duke

Charity Navigator Planning Now For The Estate Tax Overhaul

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Biden Corporate Tax Increase Details Analysis Tax Foundation

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

Proposed Impact Of The American Families Plan Tax Proposal Fein Such Kahn Shepard

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Estate Tax In The United States Wikipedia

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

House Estate Tax Proposal Requires Immediate Action

Big Tax Hikes Could Lie Ahead Adviceperiod

What The Proposed Tax Plan Means For Commercial Real Estate Voit Real Estate Services

Proposed Tax Changes Focus On The Wealthy The New York Times

Asking Wealthiest Households To Pay Fairer Amount In Tax Would Help Fund A More Equitable Recovery Center On Budget And Policy Priorities

Build Back Better Act And Estate Planning

Income Estate Capital Gains Tax Hikes Retirement Account Crackdown House Finally Details How It Will Fund 3 5 Trillion Social Policy Plan